You may be paying additional tax if you don’t have a private hospital insurance policy.

Medicare Levy vs the Medicare Levy Surcharge

Almost all taxpayers pay the Medicare Levy which is levied at a rate of 2% of your gross taxable income.

The Medicare Levy Surcharge is an additional charge if you don’t have a private hospital insurance policy. Not all policies cover you for private patient hospital stays, so be sure to check that you have a complying policy for tax purposes.

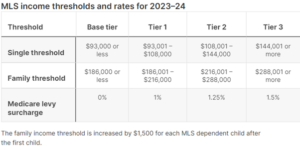

The Surcharge is levied in income tiers once your taxable income is more than $93,000 for singles and $186,000 for families.

Source: https://www.ato.gov.au/individuals-and-families/medicare-and-private-health-insurance/medicare-levy-surcharge/medicare-levy-surcharge-income-thresholds-and-rates

Are your kids covered?

Insurance coverage has now changed and in some circumstances you are able to retain your adult children on your policy until they are 31 years old. Previously this was up to 24 years old and the child would have to be studying.

However, whilst this insurance coverage may cover them for their medical costs, this may not protect them from having to pay the Medicare Levy Surcharge.

If your adult child is over the age of 21 years and not a full-time student and their income is above the Medicare Levy Surcharge threshold of $93,000, then they are liable to pay the surcharge. To be exempt from the surcharge they need to take an appropriate level of private health insurance for themselves.

If you are unsure of the amount of Medicare Levy you are paying, then please contact your Partner or Associate for more information specific to your circumstances.

Please note – by the time you read this blog, the facts and figures presented may have changed. Contact us for more information.